Is the Housing Market Going to Crash?

There has been so much talk about the “market shifting.” While there is no national real estate market, I can talk to the markets in which we work in the Chicago suburbs.

What I, and many other experienced local Agents, am seeing is today’s market is nothing like it was in 2008…and this is why. (Unlike the many, many new Agents there are now, I worked in the real estate industry in 2008).

1- There is still a shortage of homes for sale in our local markets.

Buyer demand continues to exceed the supply (of homes for sale). During the housing crisis, there were many homes for sale (many were short sales and foreclosures), which essentially led prices to decrease.

Here is a graph from the National Association of REALTORS (NAR) that shows just how the monthly supply of homes for sale now compares to the housing crash.

When there is less supply than there is demand, prices do not typically go down. In 2022, the monthly supply of inventory (MSI) was 2.7, meaning it would take just under 3 months to sell all the inventory for sale, compared to 10.4 months in 2008.

When the MSI is under 6, that usually indicates a seller’s market

When the MSI is at 6, that usually indicates a neutral market (not a buyer’s or seller’s market)

When the MSI is over 6, that usually indicates a buyer’s market

*Contrary to some other markets out-of-state that experience higher highs and lower lows, we are NOT in a buyer’s market in our suburban Chicago markets in the most common price range

2- Lending and Mortgage Standard Were Less Strict

Leading up to the housing crisis, it was a lot easier to get a home loan compared to how it is today. Lending institutions took on greater risk leading to many defaults, falling prices and foreclosures. That is not what is happening now.

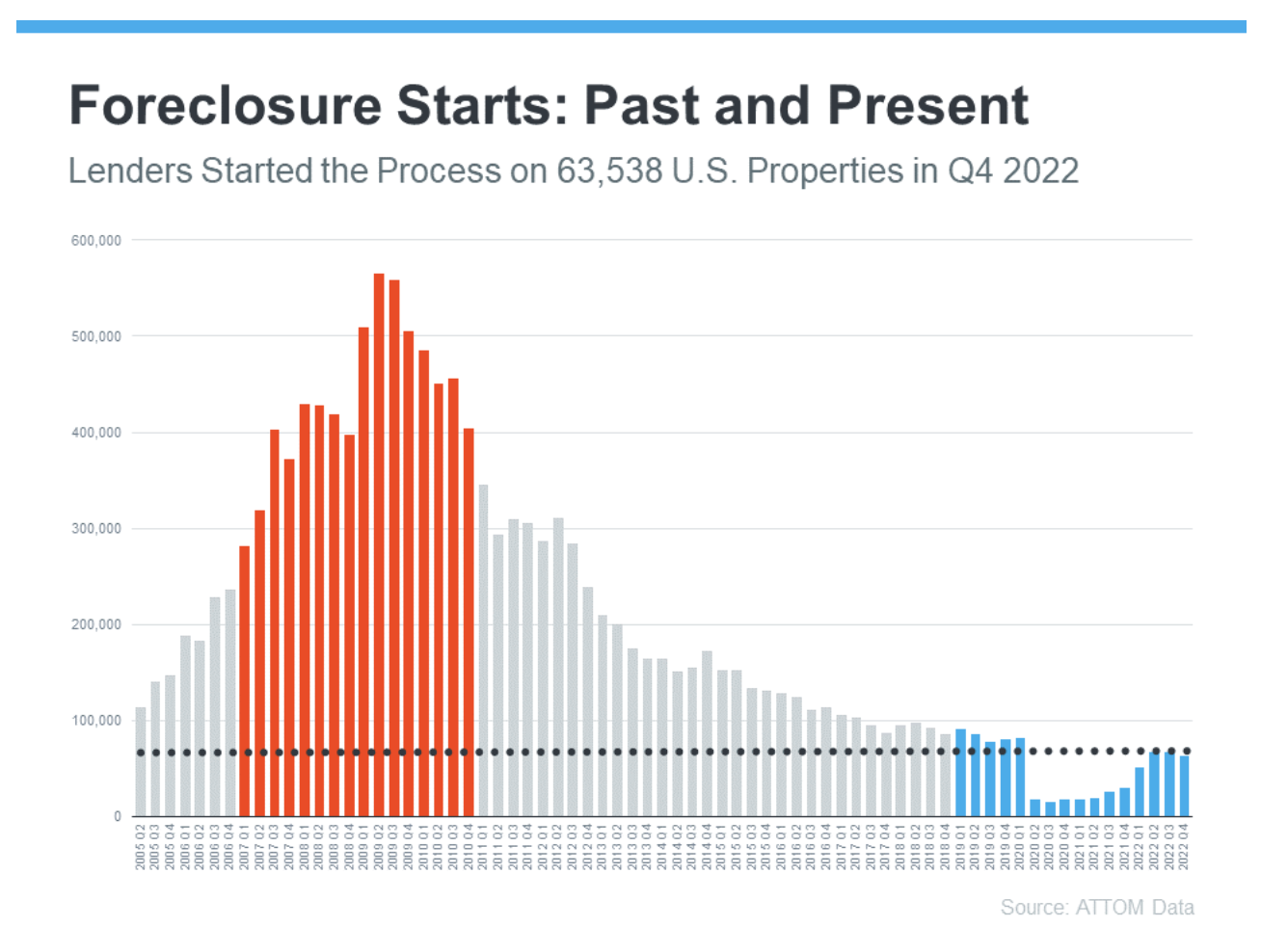

3- There Were More Foreclosures

In the years during and following the crash, there were more foreclosures with more homeowners underwater on their mortgage. Foreclosure activity has been lower since the crash as homeowners also typically have more equity in their homes, not causing homeowners to be underwater like during the crash. Additionally, because of the stricter guidelines, buyers today can be considered more qualified and thus less likely to default on their loans.

So even as foreclosures tick up, as per the graph above, the total number is still very low. And on top of that, most experts don’t expect foreclosures to go up drastically like they did following the crash in 2008. Bill McBride, Founder of Calculated Risk, explains the impact a large increase in foreclosures had on home prices back then – and how that’s unlikely this time.

“The bottom line is there will be an increase in foreclosures over the next year (from record level lows), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards have helped prevent a situation that could lead to a wave of foreclosures like the last time.

Real estate is hyper-local, what happens in one locale might not happen in another. To get an accurate picture of what is happening in your local Chicago suburan market, call The Glockler Group. (708) 480-2011.

Based on the source KCM, with local edits.