The Biggest Issues in the Housing Market Right Now

In Naperville and the Chicago suburbs, the biggest challenge right now is a low amount of home inventory for sale. There are simply more buyers looking for homes, especially in the most common price range, than there are homes for sale that buyers are interested in.

Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply:

“Two dynamics are keeping existing-home inventory historically low – rate-locked existing homeowners and the fear of not finding something to buy.”

That is certainly something, we as Naperville and suburban Chicago REALTORS, see as the most common reasons (if not the only reasons) sellers aren’t looking to sell. I have also had conversations with some local homeowners who are simply waiting to move because the market where they want to move, down south, could be tough for buyers.

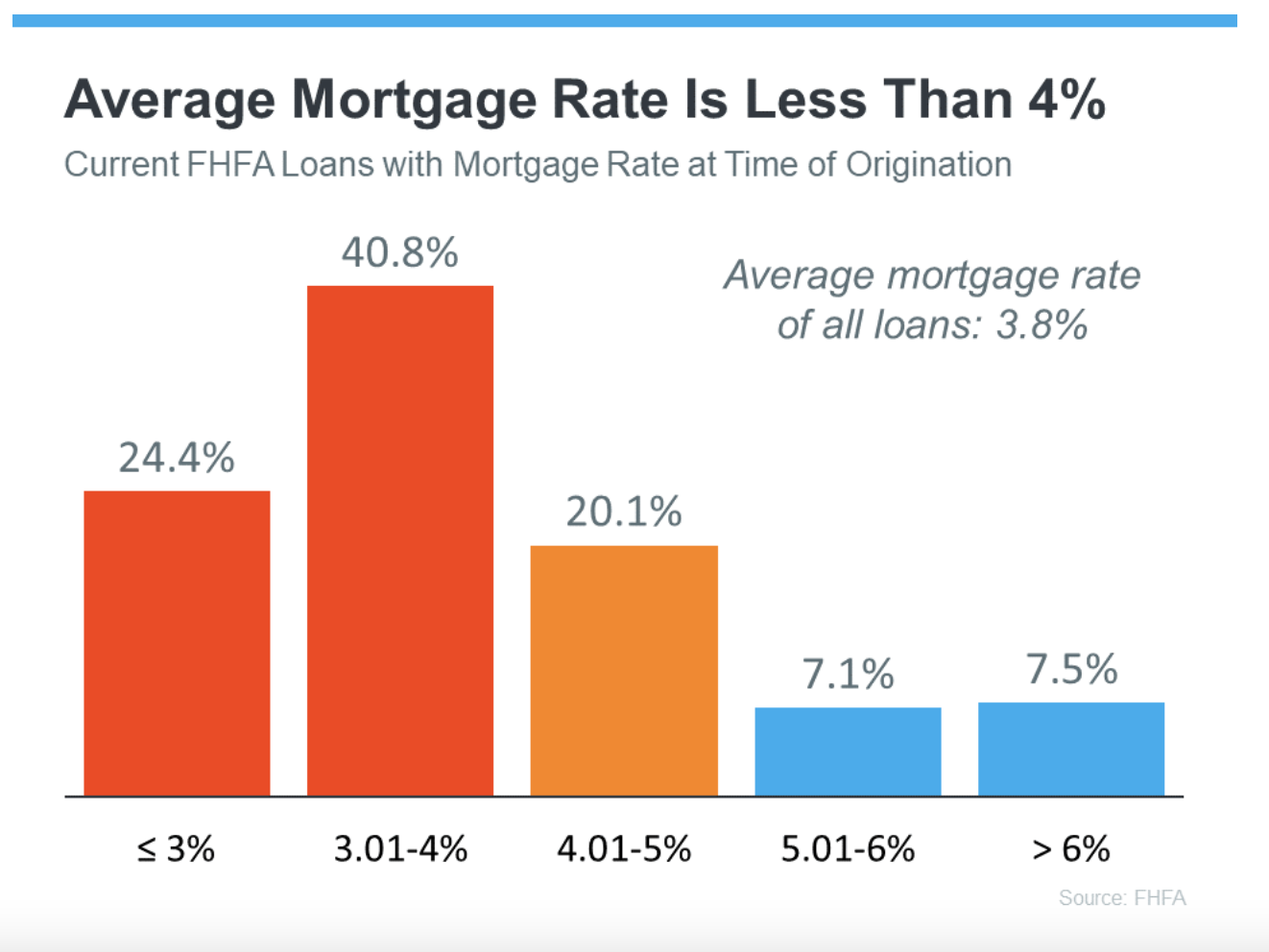

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4%.

With the mortgage rate, at the time of this writing, over 6% (still low, historically), some homeowners are choosing to stay in a current home to avoid paying a higher interest rate on a different home.

Homeowners with 100% equity in a home, who did not take out a mortgage, have more flexibility if they are planning on paying cash for the next purchase. With the southwest, west and northwest Chicago suburbs (and the midwest in general) offering more affordable housing, it is not uncommon for there to be a good number of cash buyers in the local market.

Another factor holding some back from selling is fear of not finding a suitable home to buy.

In our experience, more sellers than ever (if the situation allows) are purchasing a property first and then selling the current home, for that reason. With many Chicago suburban markets still being competitive for buyers, an offer that is contingent on a sale, or close of a current home (in the most common price range), can sometimes be difficult when competing against cash buyers or buyers who do not have a sell a home before purchasing. A local, highly experienced lender can go over with you, whether you’d be able to buy first and then sell.

What does this mean for local home sellers and buyers?

With lower inventory, homeowners who are choosing to sell, can take advantage of a market that typically is still leaning in the seller’s favor.

Buyers appreciate more inventory and more properties from which to choose.

Who you work with makes a difference, The Glockler Group is your local, highly experienced real estate team and we can help discuss options you may have right now, which could include leveraging your current home equity. According to ATTOM:

“. . . 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.”

Kristine Glockler is a proactive, Top-Notch REALTOR covering Naperville, Aurora, Plainfield, Orland Park and the surrounding west and southwest suburbs of Chicago.

(708) 480-2011